CES The quantum computing industry seems to be just as delicate as the qubits it relies on. Shares in some publicly traded QC companies saw steep declines today, following Nvidia CEO Jensen Huang’s CES rather reasonable remark that practical quantum systems may still be 20 years away.

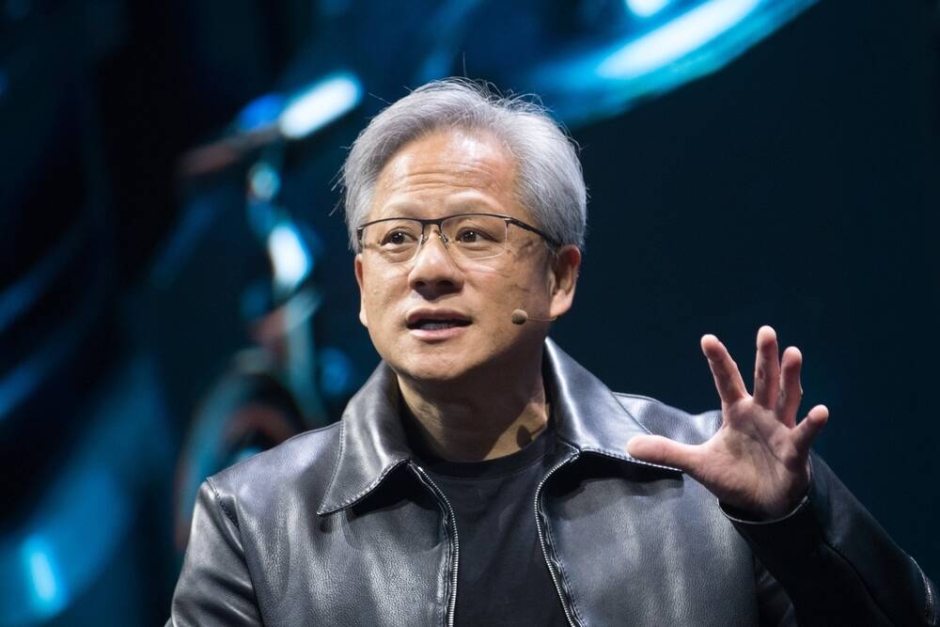

Speaking at a financial analyst Q&A session at the electronics super-conference yesterday, Huang said (39:30 into the video) the world is probably five to six orders of magnitude away from the number of qubits needed to make practical quantum computers – and he doesn’t expect anyone to break that threshold anytime soon.

“If you said 15 years for very useful quantum computers that would probably be on the early side,” Huang predicted. “If you said 30, it’s probably on the late side. If you picked 20, I think a whole bunch of us would believe it.”

Yes, keep buying those Nvidia GPUs for another couple of decades, please. Huang’s grim but frankly realistic outlook on the future of quantum computing added to the sector’s woes, with some companies seeing stock prices plummeting when markets opened the next day.

D-Wave, Quantum Computing Inc, Rigetti, and IONQ are all down nearly 50 percent as of writing. The only leading publicly-traded quantum computing firm to escape a 50-percent decline in value is UK-based Arqit Quantum, but it’s still down by around 30 percent.

To be fair to all those suddenly endangered quantum computing firms, this isn’t the worst news they’ve had recently.

The quantum industry started off 2024 in pretty bad shape too, with news breaking early last year that VCs had invested 50 percent less money in the space in 2023 as generative AI became the big gamble of the year. By late last year, D-Wave and Rigetti were both facing delisting from US markets due to shares falling below the $1 mark.

As of writing, D-Wave shares are worth about $5, with Rigetti sitting at $9.50. Both companies – and the others losing cash today – made most of their gains past the $1 mark in December thanks in part to positive earnings reports, stock offerings, and IONQ shipping its first quantum computer to Europe, per the Motley Fool. Whether those gains will be erased following Huang’s comment remains to be seen, but the early signs aren’t positive.

Not that the quantum industry recently hasn’t faced its share of challenges. In 2023, a study demonstrated that a single NVIDIA GPU outperformed hypothetical quantum setups in certain workloads that quantum computing has long been touted as excelling at. Meanwhile, DARPA published the results of an assessment last year that evaluated whether quantum computers will deliver on the promise of solving problems that stump classical machines – yielding mixed results.

Even some of the so-called most powerful quantum computers that creators claim are too complex to simulate on classical hardware, still regularly make errors. This means they haven’t yet demonstrated a clear, practical advantage over conventional systems, though progress in error correction is being made.

- NIST finalizes trio of post-quantum encryption standards

- Quantum computing next (very) cold war? US House reps want to blow billions to outrun China

- You can cross ‘Quantum computers to smash crypto’ off your list of existential fears for 30 years

- Crypto-apocalypse soon? Chinese researchers find a potential quantum attack on classical encryption

That might be yet another reason why Nvidia is doing so well while the rest of the quantum world is struggling: Huang said his company has become indispensable to almost every quantum company in the world, largely due to their exceptional error rates.

“It turns out you need a classical computer to do error correction with a quantum computer, and that classical computer better be the fastest computer that humanity can build,” Huang said yesterday. “That happens to be us.”

Huang said most quantum computing companies are turning to Nvidia, which has created a quantum variant of its CUDA parallel computing platform, for their algorithm and architecture simulations, and even to develop quantum computer designs.

In short: If you’re developing one of those quantum computers that are still a couple of decades off, your path probably leads through Jensen and his chip shop, so feel free to keep sinking cash into the endeavor.

“We want to build computers that solve problems that normal computers can’t,” Huang said, putting Nvidia in an ideal position to be “the perfect company to be the classical part of quantum.”

The Register reached out to all the quantum companies mentioned in this story; none had provided a comment at the time of writing. (r)

Updated to add at 2325 UTC

D-Wave CEO Dr Alan Baratz said The Register the Nvidia CEO’s statements are “just the latest in a string of misinformation” driving a negative market reaction to quantum computing, and claimed Huang has a misunderstanding of quantum.

“While he might be right about other quantum companies, he is dead wrong about D-Wave,” Baratz said, citing D-Wave’s “different approach” to building a quantum computer that’s put the upstart “likely many years ahead” of its competitors in commercializing its tech.

“There is massive potential for AI and quantum to work together in advancing the limitations of today’s classical computing capabilities,” Baratz told us.

“We welcome the opportunity to partner with companies like Nvidia in exploring what’s possible when quantum processing units (QPUs) and GPUs come together.”